Valuation for mergers and acquisitions

Strategic decisions with a solid foundation

At what price do you intend to buy or sell a business? Making a strategic decision to buy or sell a business requires a deep understanding of the company’s value. Additionally, this valuation can play a pivotal role in price negotiations. Knowing the valuation ensures your decision-making process is well-supported.

This is how TIC Advisory can assist during a merger or acquisition process:

- Clarifying the standalone value of a company;

- Identifying value drivers (competitive advantages) and synergistic benefits in a potential transaction;

- Providing insights to stakeholders (shareholders, supervisory board, management, etc.);

- Supporting negotiations over the offer, letter of intent (LOI), and the purchase-sale agreement (SPA);

- Offering a fairness opinion;

- Managing the process during a merger or acquisition;

- Integrating the acquisition into the financial statements.

The outcome

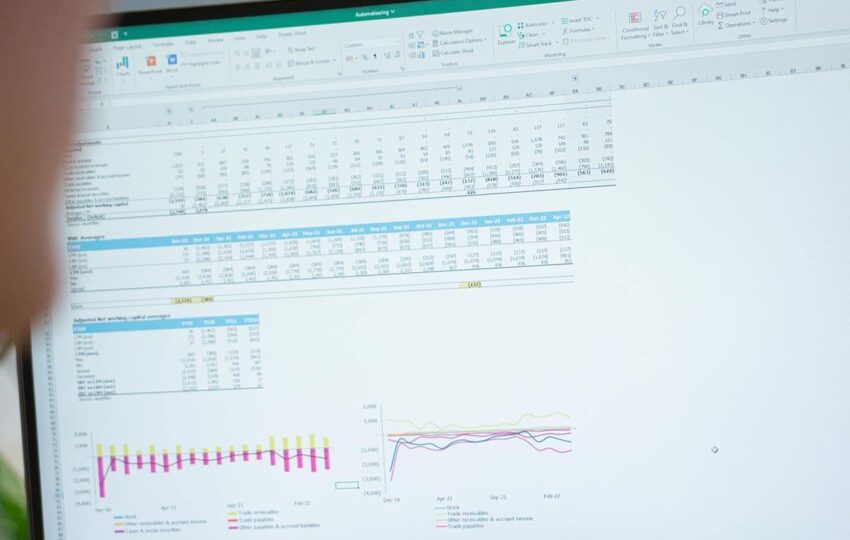

The valuation is based on a thorough company analysis, including its historical development, competitive advantages, market, and industry. Moreover, a benchmarking of the company against comparable businesses is conducted.

In this way, the determined value remains robust in negotiations, ensuring you have a reliable partner by your side throughout.