Buy-side / Acquisition Due Diligence

Acquisition Due Diligence: Unveiling opportunities, mitigating Risks

In the dynamic world of mergers and acquisitions, successful deals are driven by informed decisions. Whether you’re a seasoned corporate player or a visionary entrepreneur looking to expand your portfolio, one crucial step stands between you and a thriving acquisition – Acquisition Due Diligence.

What is Acquisition Due Diligence?

Acquisition Due Diligence relates to the process of carefully examining and analyzing the financial aspects of a target company before completing an acquisition, in order to uncover potential risks and opportunities. This process provides you with essential insights necessary for making well-informed investment decisions.

Why is Acquisition Due Diligence important?

Acquisitions are a strategic move to expand your business or enter new markets, but they also come with significant financial risks. Without a clear understanding of the target company’s financial health, you’re navigating uncharted waters. This is where we come in.

What we offer

Our financial M&A Due Diligence for acquisitions is designed to empower you with the insights and information needed to make sound investment decisions. Here’s how we can assist:

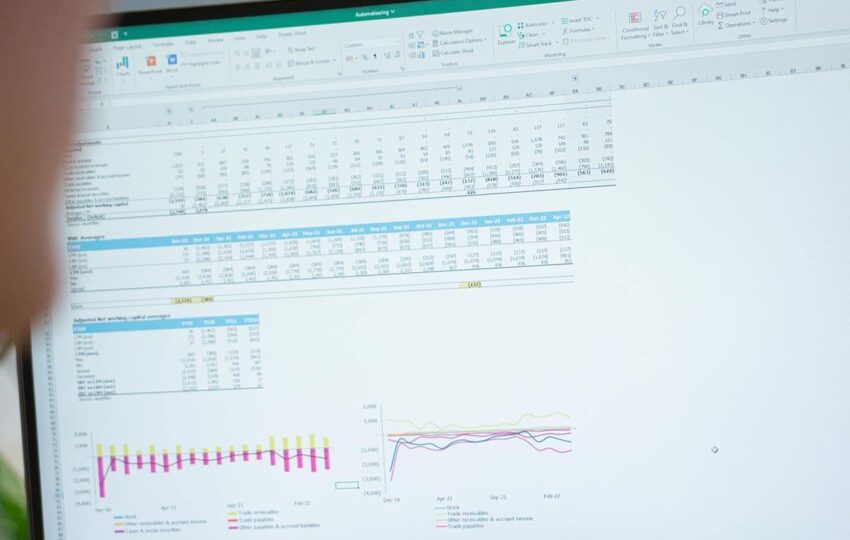

- Validating financial assumptions: We delve deep into the financial assumptions of the intended transaction to ensure they are confirmed.

- Timely identification of relevant matters: We identify all relevant issues in a timely manner so that you won’t encounter any surprises.

- Supporting the negotiation process with factual arguments: We provide you with the right factual arguments to support the negotiation process.

Our approach

For us, M&A Due Diligence goes beyond a mere financial review. We approach the transaction from the perspective of the bid or letter of intent and assist you in determining precisely what is being acquired. We analyze and interpret the historical and forward-looking financial information provided by the seller and pay close attention to any normalization adjustments.

Through our pragmatic approach, we ensure that a good rapport between the buyer and the target company’s management is maintained.

Let’s get started

Don’t let the uncertainties of acquisitions hold you back. Take control of your financial future with our financial Due Diligence for acquisitions. Contact us today to schedule a consultation and discover how we can help you unlock the full potential of your acquisitions while minimizing risks. Together, we will realize your acquisition ambitions.